Which types of companies are best positioned to navigate and even benefit from this sort of environment? Our answer: Insurance Brokers.

In a world where the global economic outlook can be flipped around with a single tweet, it has become harder than ever to predict the future. However, there is one thing we can say with confidence: the level of risk and uncertainty has gone to a whole new level… and is unlikely to subside any time soon.

The big question is: Which types of companies are best positioned to navigate and even benefit from this sort of environment? Our answer: Insurance Brokers.

Pella has always seen Insurance Brokers as attractive stocks to own in uncertain times and they have served us well during previous bouts of market volatility.

Their financial performance has proved to be resilient to economic shocks and slowdowns. For example, their organic growth remained positive throughout the COVID period.

The services that the Insurance Brokers provide become more valuable as their customers encounter new forms of risk.

Their primary service (arranging insurance coverage) is specifically designed to help customers identify, measure, and mitigate the risks facing their own businesses.

Unlike the insurance companies themselves, the brokers benefit from these rising premiums without having to make the payouts on the associated claims.

The Consulting side of the business (which includes Health, Wealth and Employee Benefits advice) also tends to be relatively resilient to a slowing economy. It is not quite as resilient as the Broking side, because some of the services provided by the consulting businesses are discretionary, whereas the annual purchase of insurance is entirely non-discretionary.

Over time, however, the demand for consulting services should also benefit from the ongoing increase in economic, geopolitical and regulatory uncertainty.

Pella’s portfolio includes two Insurance Broker stocks:

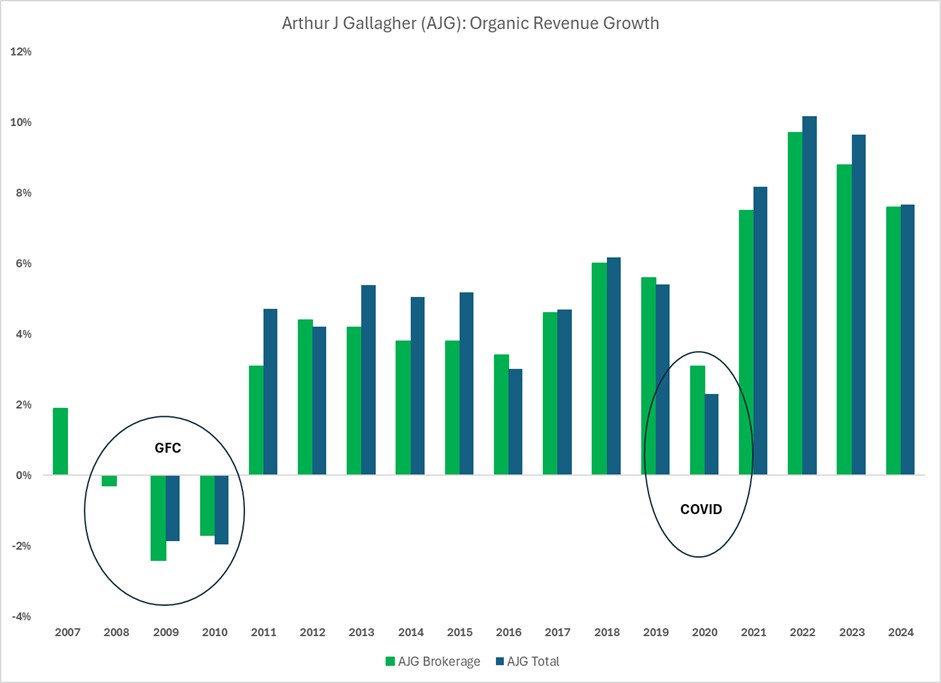

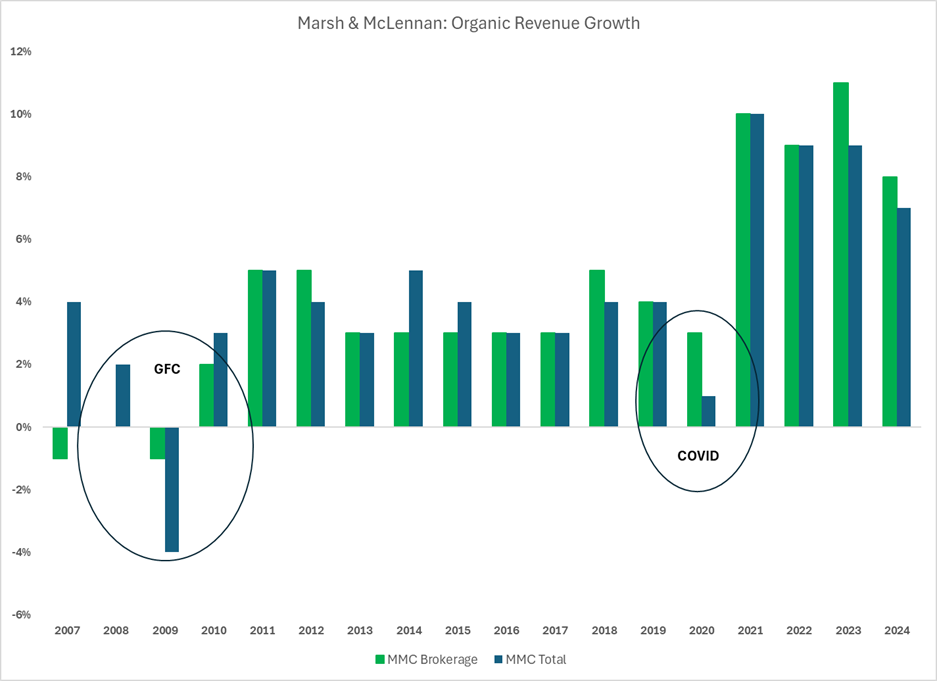

The charts below show the resilience of both companies’ business models during periods of severe economic stress.

When COVID pushed the global economy into recession in 2020, AJG and MCC were both able to maintain positive organic revenue growth.

Even during the carnage of the GFC back in 2008/09, both companies experienced only a modest decline in revenue. This was despite the GFC coinciding with one of most severe “soft markets” for global insurance pricing in recent memory. Commercial premium rates declined by more than one-third between 2003 and 2010, placing significant downward pressure on commission revenues.

Most importantly, both stocks have been able to compound significant growth in revenue and FCF over time, unlike most other “defensive” stocks where the trade-off for safety tends to be uninspiring growth.

Over the past decade, AJG and MMC have both been able to triple their EPS and free cashflow per share. This equates to a compound growth rate of 11-12% pa.

In summary:

Pella sees the Insurance Brokers as attractive stocks to own in uncertain times and they have served us well during previous bouts of market volatility. Despite their strong share price performance in recent years, AJG and MMC continue to satisfy Pella’s stringent price-for-growth valuation methodology. They also provide the portfolio with protection against any major downturn in global capital markets as the trade war merry-go-round continues to spin.

Of course, we continually monitor the valuation equation for both stocks, as well as the various risk factors to their near-term share price performance (most significant risk: a major increase in price competition in the global market for commercial insurance). However, we remain confident in the longer-term structural tailwinds for the sector.